Featured in Bisnow:

Hall Structured Finance has closed on more than $100M in loans in the past quarter and expects to end the year with almost $200M in loans. But, that’s slightly more than half of what HSF expects to do in 2016 with a goal of $350M.

$350M in lending isn’t impossible with the opportunities available, says Hall Structured Finance president Mike Jaynes. Now is the time to capitalize on the opportunities available. Of the $103M in recent lending, $73M has been in the hospitality sector across the country, Mike tells us. There’s the $13M Home2Suites by Hilton in Atlanta; an $18M Hyatt House in Orlando; a $23M Esplendor Hotel in Bay Harbor Islands, FL; and the $19M Doubletree by Hilton in Hilo, HI. Mike says deals have been steady all year, but it’s harder to get deals closed, in general. One recent deal has been in the works since the end of 2014, for example. Today, HSF has about $170M in deals tied up and termed up with deposit money in the bank waiting for an application to be closed or the due diligence process completed.

The hospitality industry has gotten frothier, Mike (with son, Josh) says. There are lot of rooms planned or under development. But, overall, the demand is there, as are the metrics and economics. The window of opportunity is here and should remain open through next year, Mike tells us. One of the reasons HSF likes playing in the hotel space is the lack of lending competition for construction loans (most are going after the multifamily deals). As a lot of banks scale back on a sector, that’s when HSF dives in, Mike says. “We love the hotel space; we can do the same type of structure and pricing on a Class-C or B multifamily property or an empty office building or we can get behind a brand-new marquee flag hotel in a major market.” Most loans are 70% to 80% loan to cost. The hotels don’t have to be in major markets; but an opportunity in a secondary market may not be as high in the capital stack and HSF may lower its exposure a bit, he tells us. HSF likes the $10M to $45M loan range.

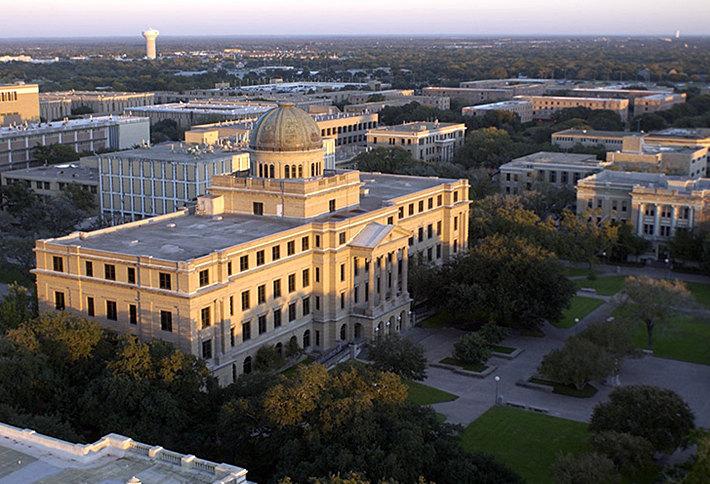

The most recent deal HSF closed is the $30M loan on the future Holleman Village student housing project at Texas A&M in College Station. We don’t see many student housing projects, Mike says, but this deal (with a Chinese developer with a lot of cash equity backing the project and a quality team involved in the development and property operations) has a good story to it. The Holleman Village development will contain 19 three-story buildings offering 432 furnished units with 792 beds, a three-story clubhouse and leasing office, and 1,020 surface parking spaces. The project spans more than 30 acres and is 1.5 miles south of Texas A&M at a campus bus stop. The project will be built in phases with some of the units available for the fall 2016 semester. The remainder of the units are planned to deliver in time for the spring 2017 semester. Hall Structured Finance also recently made the move from Hall Office Park in Frisco to KPMG Plaza at HALL Arts, an 18-story, 500k SF office building developed by the firm’s parent company at 2323 Ross Ave in the Dallas Arts District in Downtown Dallas.

View full story here.

Back To News Room

News Room

Related Articles

Scroll to explore related Articles from HALL Structured Finance team