HALL Structured Finance Broker Spotlight Series

The HALL Structured Finance (HSF) team spoke with Ryan Bosch, principal at Arriba Capital, on his journey to a career in finance, partnering with HSF and his insight on future trends in the market.

How It Started

It’s not every day that you meet someone who started off owning a paintball company and then transitioned into a highly successful career in finance. Ryan Bosch, principal at Arriba Capital did just that.

What started as an interest in middle school turned into owning one of the largest paintball goods manufacturers in the world, NXE Paintball, distributing throughout South America, Europe and Asia. Those strong connections would later be crucial, especially when pivoting to a consumer goods manufacturing company in 2013, which served clients such as Verizon and Best Buy.

In 2016, Bosch made the switch over to finance after mutual connections at Arriba recruited him to the boutique firm. It didn’t take long for him to know he had made the right move.

Turning Dreams into Reality

Bosch was brought on at Arriba to specialize in capital advisory, representing entrepreneurial commercial real estate developers in financing their projects. The company, founded in 2012, has offices in Scottsdale, San Diego and Chicago, and is centered around three core principles – each of which are key values Bosch believes in – Integrity, Creativity and Assurance.

“I love helping people realize their dreams and goals on a project,” said Bosch. “We play a small part, but when it’s someone’s first major development deal and seeing that project cross the finish line, it makes all the hard work worth it every time.”

Not only does the company deliver on ethics, but Arriba’s track record of completed transactions speaks volumes about their ability to execute and deliver competitive and innovative realty capital, with $750 million in originations in 2022 with the bulk of projects in hospitality and construction.

Working with HALL Structured Finance

Arriba’s passion for its clients is one of the things that convinced HSF to partner with their team – and the feeling was mutual. “HSF takes an institutional approach but with an entrepreneurial, family-owned feel. They run a great process, move quick, and offer creativity when hurdles arise within a deal.”

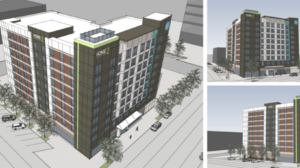

The latest HSF and Arriba deal was a dual-branded, 221-key, Home2 Suites by Hilton and Tru by Hilton in downtown Houston. HSF provided a $37.4 million loan to fund construction, while Arriba served as the mortgage broker.

“Ryan and the entire team at Arriba continue to be a great partner, especially in the hotel construction loan segment of debt markets,” said HSF Vice President Brian Mitchell. “They work hand-in-hand with their clients to really understand their needs and build the proper trust on both ends – working with them on this project was invaluable and efficient.”

The nine-story, 123,000 square-foot project is expected to be completed by the third quarter of 2024. Once complete, the hotel will offer extended-stay options, as well as traditional lodging options.

Looking Toward the Future

Looking toward the future during these times can daunting, but Bosch’s positive outlook should inspire developers to continue moving forward.

“The hotel construction pipeline is up 14% which is higher than it’s been in the last few years. There is a unique opportunity for those who have decided to push forward – they will be opening in a rebounded economy with limited new supply and a better credit environment for permanent financing.”

Although hotel construction interest rates are affecting deals, players are also seeing some construction costs drop, such as steel and lumber, which is helping to alleviate additional costs and concerns.

“I think there are many positive underlying fundamentals that people should look forward to. Every major projection still sees a rise in RevPAR of over 3.5% in 2023 despite expectations of a mild recession. There are a lot of exciting things on the horizon in the hospitality space.”

Back To News Room

News Room

Related Articles

Scroll to explore related Articles from HALL Structured Finance team