The hospitality and multifamily real estate sectors are evolving rapidly, driven by shifting consumer preferences, sustainability initiatives, and technological advancements. For lenders and developers, adapting to these changes is essential for staying competitive. HALL Structured Finance (HSF) is at the forefront of financing these developments, offering tailored lending solutions that help developers bring innovative projects to market.

The Rise of Flexible Hospitality Models

The demand for hybrid hospitality models—integrating elements of hotels, co-living spaces, and extended stays—is increasing. According to Ben Walker from Hospitality Investor, “Hybrid hospitality refers to the blending of traditional hotel concepts with living models like BTR, co-living, co-working, members clubs, and student housing,” offering flexible environments that serve various guest needs. Developers are rethinking traditional hotel structures to cater to travelers seeking long-term stays, remote work accommodations, and multi-purpose living arrangements.

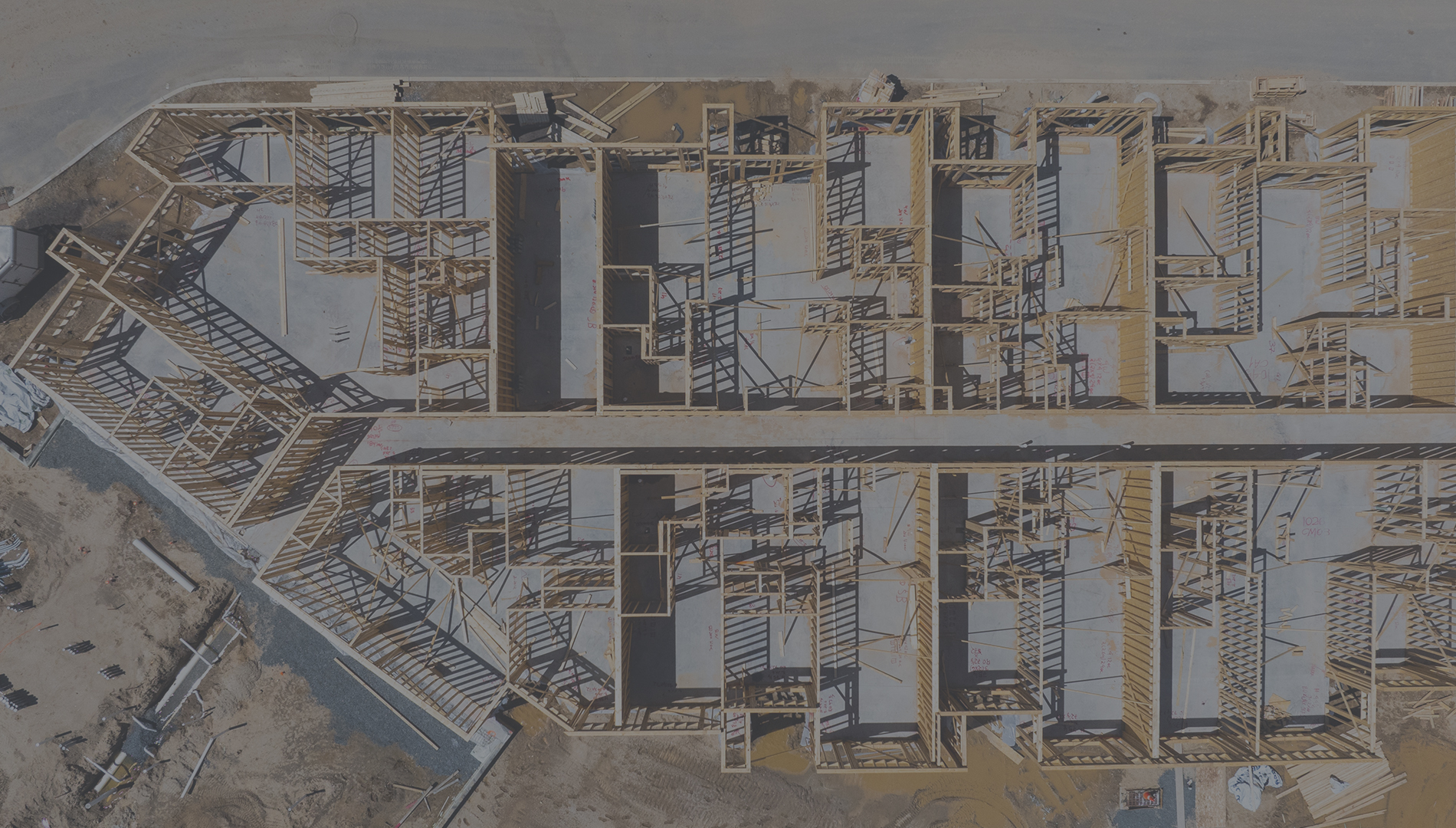

Multifamily Growth and Sustainable Living

Multifamily development remains a strong investment, particularly in secondary markets experiencing population and job growth. A major trend is the integration of sustainability-focused designs, such as energy-efficient buildings and wellness-oriented amenities. According to The Business Research Company, “The multifamily housing green buildings market has grown rapidly in recent years. It is expected to rise from $165.26 billion in 2024 to $197.34 billion in 2025 at a compound annual growth rate (CAGR) of 19.4%.” HSF provides financing for developers prioritizing green initiatives, helping them secure funding for projects that meet modern tenant expectations while increasing asset value.

Financing Considerations in a Changing Market

Traditional lenders have tightened lending criteria in response to economic shifts, but private lenders like HSF continue to provide flexible and creative financing solutions. Whether through construction loans, bridge financing, or mezzanine debt, HSF works with developers to structure deals that support successful project execution. These alternative lending structures are vital in a market where capital access is evolving.

Conclusion

As hospitality and multifamily sectors evolve, financing must evolve alongside them. With a forward-thinking approach and deep understanding of emerging models and sustainable priorities, HALL Structured Finance plays a crucial role in funding the next generation of developments, enabling developers to meet shifting demands with projects that offer long-term value.

Back To News Room

News Room

Related Articles

Scroll to explore related Articles from HALL Structured Finance team