News | December 19, 2025

Why 2026 Marks a Transitional Phase for Commercial Real Estate Capital

As the commercial real estate market moves toward 2026, capital is not disappearing — it is becoming more selective.

Read MoreInsights | December 5, 2025

Looking Ahead: How CRE Bridge & Construction Lenders Can Position for 2026

As 2025 winds down, commercial real estate lenders have a valuable chance to pause, assess, and recalibrate strategy for 2026. Across many sectors, pricing is showing signs of stabilization after a period of adjustment — a trend that can inform updated underwriting, risk thresholds, and long-term planning.

Read MoreNews | November 21, 2025

Financing the Future of Work: The Role of Office Construction Loans in Today's Market

The way companies use office space continues to evolve, demanding environments that are flexible, amenitized, and experience-driven.

Read MorePress Release | November 17, 2025

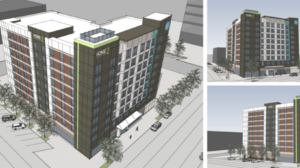

HALL Structured Finance Originates a $108 Million Loan for the Construction of 515 Walnut Tower in Des Moines, Iowa

HALL Structured Finance announced that the company has originated a $108 million first lien construction loan in connection with the development of a new apartment project, 515 Walnut Tower, in Des Moines, Iowa.

Read MoreNews | November 7, 2025

What Is Non-Recourse Financing in Real Estate?

Not every loan requires personal guarantees. For developers, the ability to borrow without tying financing to personal assets can be a game-changer. That’s the value of non-recourse financing, which limits liability to the property itself.

Read MoreInsights | October 24, 2025

Understanding Construction Loans in Commercial Real Estate

Every development starts with an idea—but transforming that idea into a completed building requires capital. For most developers, that means securing a construction loan for commercial real estate. These loans are designed to finance everything from land acquisition and site preparation to labor and materials, making them one of the most important steps in moving a project forward.

Read MoreInsights | October 8, 2025

Multifamily Construction Lending: How Developers Secure Funding

At HALL Structured Finance, we’ve made multifamily lending a core part of our platform. Over the years, we’ve financed communities nationwide and seen how important it is to structure loans that align with development timelines and market conditions. By offering tailored solutions—including non-recourse terms—we help developers access capital in a way that reduces risk while supporting growth.

Read MoreNews | September 30, 2025

Private Lender Opens Door to C-PACE Financing, Giving Borrowers an Edge Over Traditional Banks

In today’s evolving commercial real estate finance landscape, where borrowers face rising interest rates, tighter capital markets and increasing cost pressures, there is growing demand for innovative funding solutions. Against this backdrop, Dallas-based private lender Hall Structured Finance stands out — not just by offering capital, but by providing smart, flexible capital solutions.

Read MoreInsights | September 26, 2025

Financing Hotels - What to Know About Hotel Construction Loans

Hotel development is one of the most complex areas of commercial real estate. Beyond bricks and mortar, it involves pre-opening expenses, operational risk, and the challenge of stabilizing performance in a cyclical industry. That’s why hotel construction loans exist—to meet the specific demands of hospitality projects that traditional lenders often shy away from.

Read MoreInsights | September 16, 2025

Why Tailored Financial Solutions Matter in Real Estate Financing

By adjusting terms and structures to fit a project’s unique requirements, tailored lending helps developers secure financing that supports both immediate goals and long-term success.

Read MorePress Release | September 8, 2025

HALL Structured Finance Originates $40.89 Million Loan for Hotel Construction in Fort Lauderdale, Florida

HALL Structured Finance (HSF) announced that the company has provided a first lien construction loan totaling $40.89 million to finance the development of a new Hotel Indigo in Fort Lauderdale, Florida.

Read MoreInsights | September 5, 2025

Understanding Loan Terms: What Developers Need to Know

Real estate financing can feel dense if you’re not fluent in the language. From acronyms to industry-specific phrases, the terminology surrounding commercial loans isn’t always straightforward—but it matters.

Read MorePress Release | September 3, 2025

HALL Structured Finance Provides $30 Million Loan for New Marriott Tribute Portfolio Hotel in Santa Barbara, California

HALL Structured Finance (HSF) announced today that the company has closed on a $30 million first lien construction loan for the development of a new Marriott Tribute Portfolio hotel in Santa Barbara, California.

Read MorePress Release | August 25, 2025

HALL Structured Finance Originates $68.5 Million Construction Loan for Compass by Margaritaville Hotel in Myrtle Beach, South Carolina

HALL Structured Finance (HSF) announced today that the company has closed on a first lien construction loan totaling $68.5 million to develop a Compass by Margaritaville Hotel in North Myrtle Beach, South Carolina.

Read MoreInsights | August 22, 2025

Debt vs. Equity Financing: What Developers Should Consider

When it comes to financing a commercial real estate project, one of the biggest questions we help developers answer is: Should this be debt, equity, or a mix of both? There’s no single right answer—it depends on the project, the market, and the developer’s appetite for risk and control.

Read MorePress Release | August 13, 2025

HALL Structured Finance Originates $32.4M Loan for Construction of Multifamily Development in Durango, CO

HALL Structured Finance announced today that the company has closed on a first lien construction loan totaling $32.4 million in connection with the development of a new apartment project, Affinity at Three Springs, in Durango, Colorado.

Read MoreInsights | August 7, 2025

What Makes a Strong Commercial Real Estate Loan Application

Getting a commercial real estate loan approved takes more than a solid project. It takes preparation, clarity, and a lender who understands what you’re building. While every lender has different requirements, the fundamentals of a strong application remain the same—and getting them right from the start can improve your chances of approval and lead to better terms.

Read MoreNews | August 7, 2025

CoStar: Dallas developer's finance arm marks return to office lending for first time in five years

HALL Structured Finance plans to invest $500 million in Texas office properties over next two years.

Read MoreNews | August 4, 2025

Dallas Business Journal: Details emerge on financing for purchase of aging Uptown Tower

HALL Structured Finance announced July 30 it provided a $30.8 million first-lien loan to Bradford UPT Partners LLC to "facilitate the acquisition of the office tower and fund future planned improvements."

Read MorePress Release | July 30, 2025

HALL Structured Finance Returns to Office Lending With Loan for Uptown Tower in Dallas, Texas

Dallas-based HALL Structured Finance (HSF) has announced that the company is re-entering the office lending market after focusing primarily on multifamily and hospitality financing in recent years.

Read MoreInsights | July 24, 2025

Partner Spotlight: Lēva Living

In this edition of our “Partner Spotlight Series”, we’re proud to feature Lēva Living, a dynamic real estate development company reshaping the build-for-rent landscape in Texas. We caught up with the company’s President, Jennifer Orr, to learn more about their vision, values, and collaborating with HALL Structured Finance (HSF).

Read MoreInsights | July 23, 2025

What Developers Should Know About Non-Recourse Loans

For many commercial real estate developers, non-recourse loans are an appealing way to secure capital without putting personal assets at risk. Unlike recourse loans—which hold borrowers personally liable if a project underperforms—non-recourse financing is secured by the property itself. If something goes wrong, the lender’s recourse is limited to the asset, not the developer’s personal balance sheet.

Read MoreInsights | July 17, 2025

Common Pitfalls in Commercial Real Estate Lending-and How We Help You Avoid Them

Even the most seasoned developers can hit unexpected snags when navigating the commercial real estate lending process. At HALL Structured Finance, we’ve worked with borrowers across the country and seen where projects tend to go off track—and how to keep them moving forward. While every deal is unique, there are a few recurring missteps that we help our clients avoid early in the process.

Read MoreInsights | July 10, 2025

The State of Commercial Real Estate Lending in 2025: Key Trends, Emerging Players, and the Role of Private Capital

The commercial real estate (CRE) lending market in 2025 is defined by caution, creativity, and competition. After a year of economic recalibration, developers and lenders are adjusting to elevated rates, tightened underwriting, and shifting sector demand. Here's what’s shaping the market this year.

Read MoreInsights | July 2, 2025

Navigating the Capital Stack: Understanding Debt and Equity Financing in Commercial Real Estate

The success of any commercial real estate (CRE) project hinges on securing the right financing. One of the most critical concepts in this process is the "capital stack," which defines the hierarchy of financial claims on a property.

Read MorePress Release | June 24, 2025

HALL Structured Finance Originates $53.5 Million Loan for a New Marriott Tribute Hotel in Truckee, California

HALL Structured Finance (HSF) announced today that the company has closed on a first lien construction loan totaling $53.5 million to develop the MTN Scout Hotel, a full-service Marriott Tribute Portfolio Hotel in Truckee, California.

Read MoreInsights | June 18, 2025

The Future of Hospitality and Multifamily Development: What Lenders and Developers Need to Know

This article explores evolving trends in the hospitality and multifamily real estate sectors—like hybrid models and sustainable design—and highlights how HALL Structured Finance supports developers with flexible, forward-looking financing solutions.

Read MoreNews | June 12, 2025

HALL Structured Finance Originates $36.21 Million Loan for Construction of Humble Ranch Outside Houston, TX

Dallas-based HALL Structured Finance (HSF) announced today the closing of a $36.21 million first lien construction loan to finance the development of Humble Ranch, a 160-unit, cottage-style build-to-rent community in Atascocita, Texas, located five miles from the city of Humble.

Read MoreInsights | June 11, 2025

Hospitality Recovery Trends: Key Markets for Hotel Development

The hospitality industry has made a strong comeback, with increased travel demand across leisure, business, and extended-stay markets.

Read MoreInsights | June 5, 2025

The Rise of Sunbelt Markets: Where Developers Should be Looking

The Sunbelt region, spanning the Southeast and Southwest, has become a major hub for commercial real estate investment.

Read MorePress Release | May 15, 2025

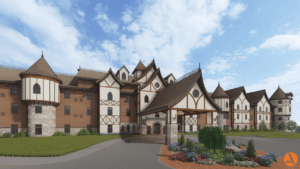

HALL Structured Finance Originates a $41.13 Million Loan for the Construction of Dellshire Resort in Wisconsin Dells, Wisconsin

HALL Structured Finance (HSF) announced today that the company has closed on a first lien construction loan totaling $41.13 million to develop Dellshire Resort in Wisconsin Dells, Wisconsin.

Read MoreInsights | April 14, 2025

Multifamily Demand in the Southeast: Market Trends to Watch

The Southeast region of the U.S. continues to experience strong demand for multifamily housing, driven by population migration, employment growth, and affordability.

Read MoreInsights | April 8, 2025

Why Texas Remains a Hotspot for Commercial Real Estate Investment

Texas continues to be one of the most attractive markets for commercial real estate investment, driven by strong population growth, business-friendly policies, and economic diversification.

Read MoreNews | March 17, 2025

Meet Bryan Smith – Director of Capital Markets at HALL Structured Finance

HALL Structured Finance is excited to announce Bryan Smith’s promotion to Director of Capital Markets.

Read MoreInsights | December 18, 2024

What Makes HALL Structured Finance Unique?

Craig HALL explains how HALL’s experience as both a developer and lender gives HSF an unique ability to understand and support borrowers for successful projects.

Read MoreInsights | December 12, 2024

What Makes HALL Structured Finance Successful?

Vice President Rebecca Reitz highlights the success of their closing and compliance processes and their evolution in the industry.

Read MoreInsights | November 20, 2024

Who does HALL Structured Finance Work With?

Don Braun explains how HSF partners with a range of sponsors, from large institutional investors to entrepreneurial real estate developers, to bring complex projects to life.

Read MoreNews | November 12, 2024

HALL Structured Finance Originates $58.92 Million Loan for Construction of the Rasha at Audubon Apartments in Magnolia, Texas

HSF announced today that the company has closed on a first lien construction loan totaling $58.92 million in connection with the development of a new apartment project in Magnolia, Texas, a rapidly growing suburb of Houston.

Read MorePress Release | November 4, 2024

HALL Structured Finance Originates a $20 Million Loan for the Construction of Cathedral Heights Apartments in Washington, DC

HSF announced today today that the company has originated a first lien construction loan totaling $20 million to develop a new apartment project and the renovation of two historic homes, in the Cathedral Heights neighborhood of Washington, DC.

Read MorePress Release | October 15, 2024

HALL Structured Finance Provides $44 Million Bridge Loan for the Hyatt Regency Hotel in Frisco, Texas

HALL Structured Finance (HSF) announced today that the company has provided $44 million under a first lien loan for the Hyatt Regency Hotel in Frisco, Texas.

Read MoreInsights | October 3, 2024

What Differentiates HSF from Other Lenders?

Jeannette McGlaun discusses what differentiates the team from other private lenders during the origination process, and how offering a wide range of flexible and creative deal terms make working with HSF more personalized and efficient.

Read MoreNews | September 25, 2024

HSF Originates $21.95 Million Construction Loan for River Creek Lofts in South Lebanon, Ohio

HSF announced today that the company has originated a new first lien construction loan commitment totaling $21.95 million to develop a multifamily development, River Creek Lofts, in South Lebanon, Ohio.

Read MoreInsights | September 10, 2024

Who Is HALL Structured Finance?

At HALL Structured Finance (HSF), we do things differently. By offering a full-service, in-house loan team from start to finish, we are able to get more deals efficiently so you can bring your development project to life.

Read MoreNews | April 25, 2024

HALL Structured Finance Partner Spotlight Series: Adam Plous

The HALL Structured Finance (HSF) team spoke with Adam Plous, chief operating officer at Contender Development, about his career journey to real estate development, his latest projects with HSF, and industry trends he is seeing in the market.

Read MoreNews | April 12, 2024

How Private Lenders Stepped In Where Banks Fear to Tread

Partner Insights spoke with Don Braun, president of HALL Structured Finance, a direct private lender, to learn about how troubled times have brought opportunity to HALL and other private lenders.

Read MoreNews | April 11, 2024

Meet Travis Bell – Loan Officer at HALL Structured Finance

HALL Structured Finance (HSF) recently welcomed Travis Bell to the team as loan officer. In his role at HSF, Travis will be responsible for originating loans for commercial real estate projects across the United States, with a strong focus on multifamily and hotel construction loans.

Read MoreNews | March 20, 2024

HSF Originates a $35 Million Construction Loan in Ormond Beach, FL

HALL Structured Finance (HSF) announced today that the company has originated a $35.75 million construction loan to develop a Residence Inn by Marriott in Ormond Beach, Florida.

Read MoreNews | January 29, 2024

HALL Structured Finance Originates a $39 Million Construction Loan For a Marriott Courtyard and Residence Inn in Sand City, CA

HALL Structured Finance (HSF) has originated a $39 million construction loan to develop a dual-branded Marriott Courtyard and Residence Inn in Sand City, California.

Read MoreNews | January 22, 2024

Meet Jeannette McGlaun – Loan Officer at HALL Structured Finance

HALL Structured Finance recently announced the promotion of Jeannette McGlaun to the position of loan officer.

Read MoreNews | January 18, 2024

HALL Structured Finance Originates a $30 Million Loan for Construction of Mint House in Washington, D.C.

HALL Structured Finance (HSF) announced today that it has originated a $30.25 million construction loan for the development of a Mint House, an executive apartment project in Washington, DC.

Read MoreNews | December 19, 2023

HALL Structured Finance Promotes Jeanette McGlaun to Loan Officer

HALL Structured Finance recently announced the promotion of Jeannette McGlaun to the position of loan officer.

Read MoreNews | November 29, 2023

HSF Originates $22M Construction Loan for The Breeze Apartments in Winter Haven, FL

HALL Structured Finance has originated a $22 million construction loan for the development of The Breeze, a six-story apartment building in Winter Haven, Florida.

Read MoreNews | November 20, 2023

HSF Originates $67M Construction Loan in Las Vegas, NV

HALL Structured Finance (HSF) announced today that the company has originated a $67 million construction loan for the development of the dual-branded AC Hotel by Marriott Symphony Park and Element by Westin Symphony Park in Las Vegas, Nevada.

Read MoreNews | October 23, 2023

HSF Provides a $24.6M Construction Loan for The Cooper in Lakewood, Colorado

HALL Structured Finance (HSF) has originated a $24.6 million construction loan for the development of The Cooper, an apartment building in Lakewood, Colorado, located 10 miles from downtown Denver.

Read MoreNews | October 18, 2023

How C-PACE Can Help Solve the Capital Crunch Problem for Developers

With high interest rates and a constrained debt market, C-PACE can help round out the capital stack on ground-up construction projects.

Read MoreNews | October 2, 2023

HSF Provides $52M Construction Loan for The Perry Hotel Naples

Dallas-based HALL Structured Finance (HSF) announced today that the company has originated a $52 million loan for the development of The Perry Hotel in Naples, Florida. The project’s developer is FOD Capital, based in Key West, Florida.

Read MoreNews | September 1, 2023

HSF Provides $52M Construction Loan for Somm Hotel & Spa

HALL Structured Finance has provided a $52 million construction loan for the development of The Somm Hotel and Spa, Autograph Collection, a luxury hotel in Woodinville, Washington.

Read MoreNews | July 6, 2023

HSF Provides $20M Loan for Element by Westin

HALL Structured Finance has provided a $20 million, first lien, construction loan commitment to finance the development of an Element by Westin in North Charleston, South Carolina.

Read MoreNews | June 22, 2023

HSF Provides $19.1M Loan for Residence Inn Hotel

HALL Structured Finance has provided a $19.1 million bridge loan for the development of the Residence Inn by Marriott Phoenix Mesa East, a 127-suite hotel project in East Mesa, Arizona.

Read MoreNews | June 9, 2023

HSF Originates $16.6M Loan for Hyatt Place Hotel

HALL Structured Finance has originated a $16.6 million first lien construction loan in connection with the development of a Hyatt Place hotel in Jackson, Tennessee.

Read MoreNews | June 7, 2023

How Developers Can Navigate the Liquidity Crunch

HALL Structured Finance loan originators Bryce Yamauchi, Brian Mitchell and Allyson Van Blarcum discuss the current climate in the capital markets and how borrowers can overcome obstacles to secure funding.

Read MoreNews | April 27, 2023

Dallas’ Pegasus Park development lands new funding

A Dallas life sciences campus is getting a financial boost from a local lender, HALL Structured Finance said it is providing new financing for the project.

Read MoreNews | March 2, 2023

Hall Structured Finance Lends $53M on New Jersey Multifamily Development

Hall Structured Finance (HSF) supplied the floating-rate loan for Sanz Managements’s 135-unit The Braddock apartment project in North Bergen, N.J.

Read MoreNews | March 1, 2023

Broker Spotlight: Ryan Bosch, Arriba Capital

The HALL Structured Finance (HSF) team spoke with Ryan Bosch, principal at Arriba Capital, on his journey to a career in finance, partnering with HSF and his insight on future trends in the market.

Read MoreNews | February 21, 2023

Addressing Refinance Challenges Faced by Borrowers

“Although the market is expecting a pullback by conventional lenders such as banks and the CMBS market, a good portion of the void can be filled by debt funds and private lenders like Hall Structured Finance, which have dry powder.”

Read MoreNews | January 4, 2023

Borrowing for Hotels in 2023 Will Be Possible but Pricey

Donald Braun, president of Dallas-based lender Hall Structured Finance, said his firm continues to be "anxious and open to do a lot of new originations in 2023."

Read MoreNews | December 1, 2022

Institutional Lending versus Private Funding: What is the Best Fit for your Project?

Recently, we have seen growing demand for private financing as traditional lending institutions have pulled back due to regulatory and capital constraints. What does this mean for developers? A greater need for private funding.

Read MoreNews | November 9, 2022

Meet the Team

Meet our Loan Officer Bryce Yamauchi. Bryce joined HALL Structured Finance (HSF) in 2021 and focuses on loan originations for HSF. Bryce is a graduate from the University of Hawaii and holds a bachelors degree in mathematics.

Read MoreNews | November 8, 2022

Growth Holdings Receives $85M Construction Loan for Otonomus Las Vegas Apartments

Las Vegas-based Growth Holdings has received a $85 million first lien construction loan for the development of Otonomus Las Vegas, a residential and short-term rental property.

Read MoreNews | November 2, 2022

Downtown dual-branded hotel project receives $37M construction loan

Dallas-based Hall Structured Finance said in a news release that it originated the first lien construction loan for the Home2 Suites by Hilton and Tru by Hilton being developed by Houston-based PA Hospitality.

Read MoreNews | November 2, 2022

HALL Structured Finance Provides $37M for Houston Hilton Hotels

HSF has financed $37.4 million for the development of Home2 Suites by Hilton and Tru by Hilton in Downtown Houston, Commercial Observer has learned.

Read MoreNews | September 20, 2022

CRE Finance Outlook: Change Also Means Chance

HALL Structured Finance reports that flexible, value-add private lenders still see deal flows in a largely ebbing economic landscape.

Read MoreNews | September 1, 2022

Financing deals abound

HSF has originated $54 million in loans for two separate construction projects.

Read MoreNews | August 31, 2022

K&K to build Hampton Inn in Texas

A new 106-room Hampton Inn & Suites in Shenandoah, Texas, will have more than 1,000 square feet of meeting space, a fitness center, lobby workstation, laundry room, a dining area with a full bar and an outdoor pool.

Read MoreNews | August 31, 2022

Hampton Inn and Suites announced for Shenandoah in 2023

A new Hampton Inn and Suites is coming to 18200 I-45 S., Shenandoah, in 2023.

Read MoreNews | August 30, 2022

Hotel Going Up Near The Woodlands Town Center

HSF arranged a first lien construction loan totaling $15.3 million to finance the development of a Hampton Inn & Suites in nearby Shenandoah.

Read MoreNews | August 24, 2022

HALL Structured Finance Originates $38.7M Loan for the Construction of the ROOST Apartment Hotel in Charleston

Dallas-based HALL Structured Finance (HSF) announced today that the company has originated a new first lien construction loan totaling $38.7 million to finance the development of the ROOST Apartment Hotel located in Charleston, South Carolina.

Read MoreNews | August 24, 2022

Company originates $38.7M for Roost project

Dallas-based Hall Structured Finance has originated a new first lien construction loan totaling $38.7 million to finance the development of the Roost Apartment Hotel in Charleston.

Read MoreNews | August 8, 2022

Marriott gets investment green light for Tempe development

A dual-branded Marriott International group hotel is headed to Arizona, USA, after the site’s developer secured the financing to begin construction.

Read MoreNews | August 3, 2022

What Rising Interest Rates Mean for New Commercial Development

HALL Structured Finance (HSF) Senior Vice President of Capital Markets Mike Canning discusses the relationship between rising interest rates and hotel and multifamily new construction. While rising interest rates present many challenges and setbacks in the market, they are just one of the factors that influence new commercial development.

Read MoreNews | July 29, 2022

Who’s buying, selling and financing?

Dallas-based Hall Structured Finance (HSF), a direct private commercial real estate lender, has originated a $43.1-million first lien construction loan to finance the development of an eight-story, 184-room Holiday Inn Express in Nashville.

Read MoreNews | July 27, 2022

Hall Structured Finance Lends $43M on Nashville Holiday Inn Express

$43.1 million first-lien construction loan to finance the development of an eight-story, 184-room Holiday Inn Express in Nashville, Tenn.

Read MoreNews | July 27, 2022

Hall Structured Finance Provides $43.1M Construction Loan for New Holiday Inn Express Hotel in Nashville

HALL Structured Finance (HSF) has provided a $43.1 million construction loan for a new eight-story hotel project in Midtown Nashville.

Read MoreNews | July 27, 2022

Notes: Demo of old-school VU-area buildings looms

Demolition looms of the three-building Louise Douglas Apartments on Elliston Place within the Rock Block, as the development company prepping to reinvent the site with a Holiday Inn Express has landed a construction loan.

Read MoreNews | July 25, 2022

Briefs: US Construction Sliding; Hilton's Jacobs on the Pipeline

A joint venture between Morristown, New Jersey-based Hampshire Companies and Frisco, Colorado-based The Pinnacle Companies has secured a debt package worth US$45.5 million from HALL Structured Finance, Dallas, Texas, to refinance a Marriott-branded hotel in northern New Jersey.

Read MoreNews | July 25, 2022

Hall Structured Finance Provides $45.5 Loan for Refinancing of Hotel in Montclair, New Jersey

Dallas-based HALL Structured Finance has provided a $45.5 million bridge loan for the refinancing of MC Hotel, a 159-room boutique lodging property located in the Northern New Jersey community of Montclair.

Read MoreNews | July 22, 2022

Who’s buying, selling and financing?

Hotels are changing hands and being financed across the country, including NewcrestImage adding a Dallas extended-stay property.

Read MoreNews | July 21, 2022

US Hotel Active Lenders: Westin Construction in Georgia Gets $75 million

This roundup features the latest financing of U.S. hotel industry deals and projects.

Read MoreNews | July 20, 2022

Hall Structured Finance Refis New Jersey Hotel With $46M Loan

Hall Structured Finance (HSF) supplied the first mortgage bridge loan on the JV’s MC Hotel in Montclair, N.J, which operates under the flag of Marriott International’s Autograph Collection.

Read MoreNews | July 20, 2022

Dual-flagged Marriott property to open in Tempe, Ariz.

Dallas-based Hall Structured Finance has closed a new $24.5 million first lien construction loan to finance the development of a dual-flagged Fairfield Inn and TownePlace Suites by Marriott in Tempe, Ariz.

Read MoreNews | July 19, 2022

EKN Development Receives $24.5M Construction Loan for Dual-Branded Hotel Development in Tempe

California-based EKN Development has received a $24.5 million construction loan for the development of a dual-flagged Fairfield Inn and TownePlace Suites by Marriott in Tempe.

Read MoreNews | July 12, 2022

Why HSF: What Sets Our Loan Program Apart?

HALL Structured Finance President Don Braun shares the advantages that come with being a direct private lender in our “Why HSF” video series.

Read MoreNews | July 12, 2022

Meet the Team

Meet our Manager of Capital Markets Bryan Smith. Bryan joined HALL Structured Finance (HSF) in 2019 and focuses on capital markets activities for HSF as well as HALL Group’s real estate holdings. Prior to joining HSF, Bryan held various roles at Foremark Real Estate and ShopCore Properties, an affiliate of Blackstone. Bryan is a graduate from Texas Christian University and holds a Finance BBA with a Real Estate concentration from the Neeley School of Business.

Read MoreNews | June 29, 2022

Loan for $40.5 million will start two Woodland hotels

A new wave of hotel proposals in a post-pandemic world is about to wash up in Woodland next. Dallas-based Hall Structured Finance has provided a $40.5 million loan to kick off construction of two hotels in that city, a 95-room Home2 Suites by Hilton and a 109-room Courtyard by Marriott.

Read MoreNews | June 27, 2022

Who’s buying, selling and financing?

Dallas-based HALL Structured Finance (HSF) has closed a new first lien construction loan totaling $40.5 million to finance the development of a 95-room Home2 Suites by Hilton and an adjacent 109-room Courtyard by Marriott in Woodland, CA. The two hotels are being developed and managed by Sacramento-based American Hospitality Services.

Read MoreNews | June 17, 2022

Meet the Team

Meet our Financial Analyst Kelsey Clay. Kelsey joined HALL Structured Finance (HSF) in 2021. Her primary responsibility is providing support through underwriting and structuring loan originations for construction, acquisition and bridge loans, with an emphasis on the hospitality and multifamily sectors.

Read MoreNews | June 15, 2022

Why HSF: How HSF Helps Borrowers Overcome Market Challenges

HALL Structured Finance Vice President of Originations Brian Mitchell shares how HSF overcomes the current market challenges in our “Why HSF” video series.

Read MoreNews | June 6, 2022

Jonathan Falik's Mark on the Hospitality Industry

The HALL Structured Finance (HSF) team spoke with CEO of JF Capital Advisors Jonathan Falik to learn more about his impressive career path and where he sees the hospitality industry going in the future. With extensive experience as an agent, advisor, principal, owner, borrower, guarantor, franchisee, lender and asset manager, Jonathan continues to leave a big mark on the industry and offers valuable insider expertise.

Read MoreNews | May 6, 2022

Where Will the Dust Settle for CRE Construction?

HALL Structured Finance examines how the construction sector is adapting to supply chain adversity and other operational challenges.

Read MoreNews | April 20, 2022

Mark DeMaria: A Developer Redefining Urban Living

The HALL Structured Finance (HSF) team spoke with award-winning developer and construction executive Mark DeMaria, the CEO of DevMar Development, a company focused on creating enduring, luxury residential developments in premier locations. Mark’s history in construction and willingness to go against the grain led to his passion for delivering cutting-edge developments. HSF sat down with Mark to learn more about his career and what he is working on next.

Read MoreNews | April 6, 2022

Primed for growth, Don Braun discusses what's next for Hall Structured Finance

Beyond its core competency of real estate, the firm has seen different iterations through the decades with investments into wine (of course), oil and gas, software, technology and venture and private equity.

Read MoreNews | March 17, 2022

Hall Structured Finance Provides $29.4M Refinancing for Serena Hotel in Aventura, Florida

Dallas-based Hall Structured Finance (HSF) has provided a $29.4 million loan for the refinancing of Serena Hotel, a Tapestry Collection Hotel by Hilton in Aventura.

Read MoreNews | February 9, 2022

Las Vegas Hampton/Hilton Property Secures Refinancing

A $44.8-million bridge loan further cements the relationship of the recently opened Hampton Inn and Home2Suites by Hilton, dually flagged at the Las Vegas Convention Center. The refinancing, via Dallas-based HALL Structured Finance, is a follow-up to the first lien construction loan HSF extended to hotel developer DG Design + Development (also based in Las Vegas).

Read MoreNews | February 4, 2022

DG Design + Development Receives $44.8M in Refinancing for Dual-Flagged Hotel in Las Vegas

DG Design + Development, a Las Vegas-based hotel developer, has obtained a $44.8 million bridge loan to refinance the recently opened, dual-flagged Hampton Inn and Home2 Suites by Hilton – Las Vegas Convention Center. Dallas-based Hall Structured Finance provided the bridge loan for the borrower.

Read MoreNews | January 10, 2022

HALL Structured Finance Sees Room for Optimism in 2022

“We’re now lending up to 80 percent loan to cost on multifamily and hotel construction loans” said Brad Ferguson, Vice President of HALL Structured Finance (HSF). He notes the company has a pipeline of about $600 million in deals going into 2022, focused predominantly on multifamily/hotel construction lending and hotel bridge lending.

Read MoreNews | January 5, 2022

Hotel Development Environment Improves, but Hurdles Remain

Allyson Van Blarcum, vice president at Hall Structured Finance, said her company has actually moved in the other direction with loan-to-cost ratios, from an average of 75% to 80%. She said the rational behind that is her company expects "a lot of pent-up capital" to hit the financing space and wants to carve out its niche before that happens.

Read MoreNews | November 11, 2021

Meet the Team

Meet our Loan Officer Brian Mitchell. Brian has five years of commercial real estate experience at HALL Structured Finance (HSF). He began his career as an intern for HSF during his summer, while obtaining a master’s degree. As Loan Officer Brian’s primary focus is originating new loans with an emphasis in underwriting and financial analysis.

Read MoreNews | November 8, 2021

Hotel Construction Lending Starts Comeback After Pandemic-Induced Freeze

When the coronavirus pandemic reached the U.S., Hall Structured Finance paused its lending for new hotel development. The company started its lending for hotel construction projects in mid to late 2020 once it determined its portfolio was healthy and could add on new projects, Vice President Brad Ferguson said.

Read MoreNews | October 26, 2021

Edison Equity Receives $23M Construction Loan for 55 Resort Apartments in Greeley, Colorado

Dallas-based Edison Equity Management has received $23 million in construction financing for the development of 55 Resort Apartments, an age-restricted multifamily property located in Greeley.

Read MoreNews | October 6, 2021

What to Know About Flex Financing

Borrowers dealing with unpredictability in real estate financing have more options than just traditional lenders. In fact, working with a private lender can have more benefits than just financing a deal and getting a project launched. That’s according to Donald Braun, President of the HALL Group and Managing Director of HALL Structured Finance (HSF), HSF is a private lender with a focus on providing multifamily and hotel construction loans and hotel bridge loans. GlobeSt.com reached out to Braun to discuss the advantages private lenders have over banks and other lending institutions and what the resulting adaptability means for developers.

Read MoreNews | September 15, 2021

Plans in the Works to Convert Benson to a Curio by Hilton

“The Benson Hotel is an iconic hotel, and we are excited for the opportunity to add to a historical experience that guests have been visiting for over 100 years,” said Mike Jaynes, president of HSF. “We are thrilled to be a part of the continued history and reactivation of this celebrated and top-ranking hotel in Portland and believe it will flourish with the addition of the Hilton Curio Collection loyalty program.”

Read MoreNews | September 14, 2021

Hall Structured Finance Lends $51M on Portland’s Historic Benson Hotel

Dallas-based private lender Hall Structured Finance (HSF) has provided $51.1 million in first lien bridge debt to Coast Hospitality to refinance and fund renovations on the historic Benson Hotel in Downtown Portland, Ore., according to information from HSF.

Read MoreNews | September 14, 2021

Lenders Rush Toward Construction Loans on Troubled Asset Classes, While They Still Can

Colorado Springs, Colo., emerged this summer as one of the nation’s hottest hotel markets. Just in time, it seems, the first Marriott International-branded, extended-stay hotel in Downtown Colorado Springs is expected to open next spring, helped by a $55.6 million construction loan that was provided by Dallas-based, private hotel construction lender HALL Structured Finance (HSF).

Read MoreNews | August 25, 2021

HALL Provides $55.6M Construction Loan on Colorado Springs Marriott Hotel

A quartet joint venture of real estate investors and developers have nabbed $55.6 million in construction debt from HALL Structured Finance (HSF) to build a dual-flagged Marriott International, SpringHill Suites and extended-stay Element by Westin hotel in Downtown Colorado Springs, according to information from the lender.

Read MoreNews | August 9, 2021

Finance firm behind Edge District apartment complex closes on $16.1M construction loan

The group behind a luxury mid-rise apartment complex planned for the Edge District has hit a financial milestone. Dallas-based HALL Structured Finance (HSF) announced today that the company has closed a new lien construction loan totaling $16.1 million to finance the development of the apartment complex dubbed The Metro.

Read MoreNews | August 3, 2021

Meet the Team

Meet our Closing Compliance Officer Renetta Gill. Renetta join HALL Structured Finance (HSF) in 2016 and now assists with closing and compliance. Renetta has been in the real estate industry for over 20 years. Prior to joining HSF, she worked at Cypress Equities in property management and construction development. She has professional experience in leasing, marketing, and property management and is a PTA healthy lifestyle chair for her son’s elementary school.

Read MoreNews | July 15, 2021

Meet the Team

Meet our Vice President of Capital Markets Mike Canning. Mike joined HALL Structured Finance in 2015. He focuses primarily on capital markets activities for HALL Structured Finance (HSF) as well as HALL Group’s real estate holdings, along with various other activities within HALL Group. Prior to joining HALL Structured Finance, he held various analytical and project management roles at GE Real Estate. Mike holds a BA in Economics and Business from Virginia Military Institute.

Read MoreNews | June 30, 2021

Meet the Team

Meet our President Mike Jaynes. Mike has over 30 years of commercial real estate experience and is directly responsible for loan originations and the asset management of HALL Structured Finance’s outstanding loans. He rejoined HALL Group in 2000 after working more than 7 years at GE Capital Real Estate as Vice President and Program Manager. At GE Capital Real Estate, Mike was responsible for the performance of equity and debt portfolios valued at more than $2 billion dollars, consisting of over 240 multifamily, office, retail and hotel assets located throughout the country. Mike is a graduate of the Ohio State University, with a BS in business administration and a concentration in real estate.

Read MoreNews | June 7, 2021

Meet the Team

Meet our Vice President Allyson Van Blarcum. Allyson joined HALL Structured Finance (HSF) in 2021 and her primary responsibility is new loan originations with a focus on sourcing, structuring, underwriting, and closing ground up construction and bridge loans. Prior to joining HSF, Allyson held debt origination roles at both ACORE Capital and GE Capital Real Estate and since 2013, she has been involved in closing over $4.5B of debt transactions. Allyson holds a BBA degree with honors in Real Estate and Professional Selling from Baylor University. She currently serves on the Board of Directors for Hope Cottage, the oldest nonprofit, non-faith-based adoption agency in Dallas.

Read MoreNews | May 24, 2021

Private Capital Eyes Hospitality Construction Market

DALLAS — The hotel sector was hit especially hard by the pandemic. With social distancing requirements and travel restrictions relaxing, the hospitality industry can finally plan for new product, according to David Cain, VP of HALL Structured Finance (HSF). GlobeSt.com reached out to Cain to discuss what’s next for hospitality construction financing, including the asset types and locations most favored by lenders.

Read MoreNews | May 20, 2021

Meet the Team

Meet our Vice President Brad Ferguson. Brad has over 10 years of combined experience in commercial real estate and portfolio management. As Vice President for HALL Structured Finance (HSF), Brad’s primary focus is new loan origination with an emphasis in underwriting, financial analysis and asset management. Prior to joining HSF, Brad held asset management roles with multiple companies overseeing commercial real estate portfolios ranging from $100 million to $2 billion. He holds an MBA from Texas State University and a BBA in real estate and marketing from Baylor University.

Read MoreNews | May 17, 2021

The Real Estate Rebound

As vaccine distribution continues, we are able to begin the rebound from the COVID-19 pandemic and the economy’s slow road to recovery. HALL Structured Finance vice president Mike Canning discusses the evolution of the multifamily and hotel industries in the wake of COVID-19 while sharing his outlook for the rest of 2021.

Read MoreNews | May 3, 2021

Meet the Team

Rebecca Reitz joined HALL Group in 1988 and was appointed to the position of compliance and closing officer for HALL Structured Finance in 2006. Rebecca is responsible for monitoring loan agreements and insuring the ongoing compliance of borrowers in such areas as financial reporting, insurance renewal, tax payments and escrows. Rebecca also acts as a closing coordinator in managing and insuring compliance with the closing checklist by borrowers for each loan closing. She has served on the Frisco YMCA Board from 2009 – 2013.

Read MoreNews | March 18, 2021

Why Private Capital Provided Construction a “Contrarian” Safety Net

The pandemic-produced downturn shows once again that the capital road less traveled, that of private lending options, can lead to major CRE success.

Read MoreNews | March 15, 2021

Why HALL Structured Finance Doubled Down on Multifamily

HALL Group, the parent company of HALL Structured Finance (HSF), was one of the largest multifamily owners in the U.S. in the 1980s. HALL Group has long-since segued into other types of real estate, while HSF has grown to become a premier lender, primarily in the hospitality sector.

Read MoreNews | February 22, 2021

HALL Structured Finance Adds Hotel Bridge, Multifamily Construction Loans

HALL Structured Finance (HSF) was one of the top firms in commercial real estate for providing hotel construction loans throughout the U.S., but when COVID-19 threw a roadblock at the hotel industry, the company needed a pivot. The result was the addition of two new programs: a hotel bridge loan program and a construction loan program specializing in multifamily projects.

Read MoreNews | January 20, 2021

HALL Structured Finance Provides $15.5M Construction Loan for Multifamily Project in Gregory, Texas

Dallas-based HALL Structured Finance has provided a $15.5 million construction loan for The Glades II, a 144-unit multifamily project in Gregory, located 10 miles outside of Corpus Christi.

Read MoreNews | January 14, 2021

HSF Closes Loan on Apartment Build Near Corpus Christi

Dallas-based HALL Structured Finance (HSF) closed a new first-lien construction loan totaling $15.5 million to finance the development of a 144-unit apartment complex in Gregory, 10 miles outside Corpus Christi. The project developer is Tim Torno with Torno Properties, LLC and his LP partner Cleburne Oaks GP.

Read MoreNews | November 5, 2020

Take Cover with Our New Bridge Loan Program

In response to the challenges facing the hospitality industry from the COVID-19 pandemic, president of HALL Structured Finance (HSF) Mike Jaynes introduces HSF’s new bridge loan program directed towards hotel owners, operators and developers in need of recapitalizing their property during these challenging times.

Read MoreNews | September 8, 2020

Leadership in a Time of Uncertainty

President of HALL Structured Finance (HSF) Mike Jaynes discusses how HSF has responded to the current pandemic that has impacted the hospitality industry, while delving into how the company has pivoted its business model to focus on the multifamily industry.

Read MoreNews | March 5, 2020

HALL Structured Finance is on the 'hunt for larger opportunities'

Hall Structured Finance is looking to finance more than $600 million in projects by the end of 2020, the firm’s president, Mike Jaynes, said. The private real estate lender has increasingly closed on larger deals in the past couple of years. Its typical range now falls between $15 million and $150 million. Jaynes said that the firm is on the “hunt for larger opportunities.”

Read MoreNews | February 12, 2020

HSF Funds Hotel Construction Near Disney World With $140M Loan

Doradus Partners has pinned down a $140M construction loan to build four new hotels near Walt Disney World Resort in Florida, according to HALL Structured Finance (HSF), which originated the debt.

Read MoreNews | February 11, 2020

Dallas’ Hall Structured Finance heads to Disney World with four hotels

Dallas’ Hall Structured Finance is starting the New Year with a trip to Disney World. The lending arm of Hall Group is making a $140 million construction loan on four new hotels with almost 1,000 rooms at the entrance to the Florida resort.

Read MoreNews | February 3, 2020

John Pascal: A Playbook for Growth in the Hospitality Industry

As Managing Director of Chicago-based Paramount Capital Advisors (PCA), John Pascal sources institutional capital, both debt and equity, for real estate investors and developers. Working in concert with Paramount Lodging Advisors (PLA), the sister company of PCA, John brings a wealth of expertise in the hospitality industry to serve his clients. As a result, John has facilitated a handful of hotel development transactions for HALL Structured Finance (HSF) over the years.

Read MoreNews | December 5, 2019

Bob Gustin: Entrepreneurial Approach to Hospitality

HALL Structured Finance (HSF) entrepreneur and borrower Bob Gustin is the Managing Member of GPG Development LLC (GPG), a real estate development company based in Albuquerque, New Mexico. According to Bob, being an entrepreneur is all about taking calculated risks, and Bob has taken many risks throughout his career, helping him create the pioneering company he leads today. HSF sat down with Bob to learn more about his entrepreneurial career and what he has working next.

Read MoreNews | December 4, 2019

HALL Structured Finance Builds on a Record Year in Hospitality Lending

Headwinds from inside the Beltway can’t dampen the momentum for HALL Structured Finance (HSF), as they rack up another record year in 2019.

Read MoreNews | November 19, 2019

Eastern Star hotel conversion gets $26.7 million construction loan

Conversion of the Eastern Star building into a Hyatt House hotel is drawing near, with the developer securing a construction loan for most of the cost. HALL Structured Finance announced it was providing Hume Development Inc. with a $26.7 million first-lien loan for the project, at 2719 K St. in midtown Sacramento.

Read MoreNews | October 29, 2019

Ed Bushor: Creating “Ohana” with Hospitality

Ohana is a Hawaiian term meaning family, and in a much wider sense, it often refers to friends, acquaintances and entire communities. HALL Structured Finance borrower Ed "Z" Bushor, CEO of Tower Development, Inc., develops real estate throughout the Hawaiian Islands with the goal of creating a sense of “ohana” between his projects and the local community. We sat down with Ed to learn more about his impressive portfolio of properties and his mission of responsible development.

Read MoreNews | October 14, 2019

How to Establish a Competitive Advantage

Mike Canning, Vice President of HALL Structured Finance (HSF), has been in the construction lending industry for 12 years. As social media has evolved during the course of his career, so has the influence and impact of face-to-face networking. An expert in the hospitality industry, Mike discusses how HSF remains competitive within this changing networking landscape.

Read MoreNews | September 24, 2019

Late Cycle Insight for Borrowers

DALLAS — To use a well-worn metaphor, we’re in the latter innings of a nine-inning economic game. But what exactly does that mean for developers looking to bring their next big thing out of the ground? As Mike Jaynes, president of HALL Structured Finance (HSF), tells GlobeSt.com, there are indeed cautionary notes at this stage in the upswing, not the least of which are the ever-rising costs of material and labor– which he pins at approximately 15 percent year-over-year.

Read MoreNews | September 23, 2019

As Pressure Grows To Make Buildings More Efficient, Owners Turn To Pace

Energy-efficiency regulations are heating up across the U.S., and commercial real estate developers and property owners are being called on to upgrade their buildings or face hefty fines. Green upgrades are not cheap, and as pressure mounts, building owners are searching for solutions to help them make changes without breaking the bank.

Read MoreNews | September 10, 2019

HALL Structured Finance Closes $86.5M Loan to Finance the Construction of a Westin Hotel in Tempe, Arizona

Dallas-based HALL Structured Finance (HSF) announced today that the company has closed a new first lien loan totaling $86.5 million to finance the construction of a full-service Westin Hotel, located in Tempe, Arizona

Read MoreNews | September 3, 2019

PACE Financing: Paving the Way for a Greener Future

As a country, we have become more and more energy-conscious over the past several years. Reagan Dixon, resident PACE financing expert for HALL Structured Finance, discusses what this means for the construction lending industry going forward.

Read MoreNews | August 22, 2019

How 1 Company Is Helping Unique Hotels Find Financing In A Down Lending Market

It's a tough time for hospitality developers. Financing for hotel properties dropped 25% during the first nine months of 2018, more than it did for any other type of property. Banks, in particular, are pulling back their exposure to hospitality lending, leaving aspiring hoteliers searching for alternatives.

Read MoreNews | August 9, 2019

HSF Team's #NationalBookLoversDay Reads

Looking for a good read for #NationalBookLoversDay? Here are 5 books members of our HALL Structured Finance team recommend:

Read MoreNews | August 6, 2019

Navigating the Ins and Outs of Construction Lending

Construction loans can be tricky, especially if it’s a hotel you’re dreaming of. Mike Jaynes with HALL Structured Finance provides some tips on how to get to closing.

Read MoreNews | July 12, 2019

Commercial Observer: HSF Lends $43M for Boston-Area Hotel Development Project

The deal will fund Lixi Group‘s work on a new Springhill Suites Hotel in Revere, Mass., an oceanfront town about five miles northwest of Boston. A short drive or train ride from Boston Logan International Airport, the four-story lodging should be a good fit for budget-conscious business travelers, according to Brad Ferguson, an HSF executive who worked on the deal.

Read MoreNews | July 12, 2019

Connect Boston: HSF Provides $43M Construction Loan for Springhill Suites

Hall Structured Finance provided a $43.3 million construction loan for a Springhill Suites hotel in Revere. The new 168-room hotel will be adjacent to the Wonderland train station on Revere Beach. Amenities at the four-story property will include an indoor swimming pool, fitness center, an oceanfront restaurant, business center and a Starbucks location.

Read MoreNews | July 10, 2019

HSF Closes $43.3M Loan to Finance the Construction of Springhill Suites in Boston

“We had a great experience working with HALL Structured Finance. Their flexible, tailored approach to financing our hotel development made this loan closure seamless, and we are looking forward to delivering this Springhill Suites to the Boston market,” said Lisi Gu, spokesman for the new hotel development.

Read MoreNews | May 28, 2019

Construction financing: What hotel lenders have to say

Hotel lenders at Meet the Money 2019 explain what they’re looking for when developers come to them seeking construction financing.

Read MoreNews | April 30, 2019

HSF’s Matt Mitchell Talks Late-Cycle Construction Lending

In today’s cutthroat race for yield, Dallas-based Hall Structured Finance (HSF) is quick off the mark.

Read MoreNews | April 17, 2019

HALL Structured Finance Forecasts Future of Hotel Construction Lending

A robust 2019 construction pipeline doesn’t negate the fact that lending is getting more restrained in these latter days of the upturn. We took the opportunity to speak with Mike Jaynes to gain insight into his 2019 outlook for construction financing.

Read MoreNews | March 19, 2019

HSF Named #1 Non-Bank Hotel Construction Lender Nationwide

Dallas-based HALL Structured Finance (HSF) announced today that the company was listed as the top non-bank hotel construction lender in the U.S. in 2018, according to research firm Real Capital Analytics.

Read MoreNews | January 16, 2019

There’s Still Room to Run in the Lending Sector

It’s true that the more things change the more they stay the same. Despite some mild fears of a correction and the end-of-year interest-rate puzzle, HALL’s Matt Mitchell is cautiously optimistic.

Read MoreNews | November 5, 2018

Hall Structured Finance Lends $42M on Las Vegas Convention Center Hotel Project

DG Development Corporation has landed a $41.7 million construction loan for its dual-branded Hilton hotel development immediately adjacent to Las Vegas Convention Center, Commercial Observer can first report.

Read MoreNews | September 14, 2018

HALL Structured Finance Secures $53M Construction Loan for Hotel Expansion in Scottsdale, Arizona

HALL Structured Finance has closed a $53 million construction loan to finance the expansion, redevelopment, flagging and rebranding of CopperWynd Resort.

Read MoreNews | September 7, 2018

5 Ways To Secure Hotel Construction Financing

For private lender HALL Structured Finance, the third-largest hotel construction lender in 2017, borrowers who can prove that they have an organized, solid project plan and track record of success in the hospitality market will attract more lenders and have their loans executed sooner.

Read MoreNews | August 6, 2018

Diversification Means "All In" On The Rising Economy

HALL Structured Finance talks to Globe St. about being “all in” on growing and diversifying its loan portfolio in 2018.

Read MoreNews | June 28, 2018

Hampton Inn in Watsonville, Calif. , secures $23M construction loan

The new 112-room hotel is anticipated to open in summer 2019, while the nearby 48-unit townhome project is expected to be completed by October 2018. The sponsorship is comprised of local Watsonville businessman Sonny Tut and his two sons.

Read MoreNews | June 15, 2018

As Spreads Compress And Costs Rise, Hotel Lenders Opt For More Flexibility

As spreads compress and costs ride, hotel lenders are opting for more flexibility. Find out how HALL Structured Finance remains competitive in the growing hotel finance market.

Read MoreNews | May 3, 2018

Q&A: Checking The Pulse Of The Q2 Hotel Financing Market

Bisnow sat down with HALL Structured Finance President Mike Jaynes to discuss his outlook on the remainder of the 2018 hospitality market.

Read MoreNews | April 12, 2018

HSF to finance development of Georgia's first Even Hotel

HALL Structured Finance closed a new first lien loan totaling $14.6 million to finance the construction of Georgia’s first Even Hotel in Alpharetta.

Read MoreNews | March 23, 2018

Why Diversification is a Smart Strategy

From geographical to asset type, diversifying is really about balancing risk for both lenders and investors, HALL Structured Finance’s Mike Jaynes tells GlobeSt.com.

Read MoreNews | March 23, 2018

Traditional Construction Capital Continues to Shrink

HALL Structured Finance has opened a Reg. A debenture offering in an effort to raise $50 million in investments to meet the growing demand for construction financing.

Read MoreNews | March 20, 2018

HSF Provides $35.5M Construction Loan for Apartment Community in Tampa Bay Area

Hall Structured Finance (HSF) has provided a $35.5 million construction loan for the development of The Vantage, a 211-unit apartment community in St. Petersburg.

Read MoreNews | February 14, 2018

Hall Structured Finance closes $17.6M loan for new California Aloft

Dallas-based Hall Structured Finance closed a new first-lien construction loan totaling $17.6 million to finance the construction of an Aloft hotel in Glendale, Calif.

Read MoreNews | January 4, 2018

Newgard nabs financing for Gale Fort Lauderdale hotel

Harvey Hernandez’s Newgard Development Group just secured a $19.15 million construction loan for phase two of its Gale Fort Lauderdale project. Dallas, Texas-based Hall Structured Finance is the lender and Aztec Group arranged the financing, according to a press release.

Read MoreNews | December 20, 2017

HSF Closes $55M Construction Loan for New CA Hyatt

HALL Structured Finance has closed on a $54.8 million loan to finance the construction of a new Hyatt property in Palm Springs, Calif. The Rael Development Corp.-owned 150-key Hyatt Andaz Hotel is anticipated to open by the end of January 2019.

Read MoreNews | December 20, 2017

Rael Development Nabs $55M Construction Loan for Palm Springs Hyatt

HALL Structured Finance (HSF) has signed off on a $55 million construction loan for a hotel to be built in Palm Springs, Calif., according to an announcement by the lender today.

Read MoreNews | December 7, 2017

Hall Structured Finance closes on loan for South Carolina Cambria Suites

Private lender Hall Structured Finance closed a new first lien loan totaling $17.3 million to fund the construction of a Charleston, S.C. Cambria Suites.

Read MoreNews | November 16, 2017

Hyatt Place Hotel to occupy Southwestern Bell building after redo

The development group, including Anthony Patel and Nick Patel of Pride Management, has obtained a $22.8 million loan for the long-vacant building from Dallas-based Hall Structured Finance, the companies announced. Renovation of the 16-story high-rise is targeted for completion by March 2019.

Read MoreNews | October 30, 2017

Think Beyond the Traditional to Secure Hotel Financing

While banks are more stringent with lending for hotel construction projects, this doesn’t signal a complete halt in development. Private and alternative lending sources, entering secondary and tertiary markets, and eyeing modular off-site building are paving the way for continued hotel development where speed-to-market without sacrificing quality and a quicker ROI are the worthwhile rewards.

Read MoreNews | October 23, 2017

Hall Structured Finance closes $17M construction loan for Arizona Marriott

Hall Structured Finance closed a new first-lien construction loan totaling $17.3 million to finance the development of a 127-room Residence Inn by Marriott in Mesa, Ariz. Suky and Jas Khangura, co-owners of Khangura Hotels, are the project developers.

Read MoreNews | October 9, 2017

Initial Deals: HSF, MCR, HREC See Activity

Dallas-based Hall Structured Finance (HSF) has closed a new, $26-million, first-lien loan to finance the construction of the Park James Hotel in Menlo Park, CA.

Read MoreNews | September 1, 2017

Hospitality Construction Lending Isn't Down. It's Adapting

HALL Structured Finance, the Dallas-based lending branch of HALL Group, has taken full advantage of the mini-vacuum of institutional lender hesitancy.

Read MoreNews | August 25, 2017

Developer Craig Hall's structured finance arm to book $1B by next year

Developer Craig Hall's structured finance arm closed on two loans totaling $42 million in California, putting Hall Structured Finance on track to have $1 billion on its balance sheets by the end of next year.

Read MoreNews | August 16, 2017

HSF Closes $42M Con Loan to Build Two Cambria Suites

Hall Structured Finance (HSF) has closed two new first lien loans totaling $42 million to finance the construction of two Cambria Suites in California—one in Sonoma County and one in Napa Valley.

Read MoreNews | May 31, 2017

Lending climate differs for new builds, existing assets

Senior loan updates, straight from the source. SVP of HALL Structured Finance Matt Mitchell spoke with Sean McCracken at HotelNewsNow to shed some light on the state of hotel construction lending across the nation.

Read MoreNews | May 23, 2017

Demand for financing high as borrowing costs increase

Speakers at the recent Meet the Money conference said availability is tightening for new-construction lending, but that hasn’t been enough to curb developers’ appetites.

Read MoreNews | April 6, 2017

Dual-Hyatt hotel project in East Moline closes on financing

Dallas-based HALL Structured Finance, a private lender to the real estate industry, announced Wednesday that it has closed a $23.2 million first lien construction loan to finance development of the 233-room, nine-story Hyatt House and Hyatt Place hotel.

Read MoreNews | February 27, 2017

Hall Structured Finance lending $300 million for new projects

Hall Structured Finance plans to make more than $300 million in construction loans this year for projects including hotels and apartments.

Read MoreNews | February 14, 2017

Five-story Ogletown Road hotel to break ground next month

A local developer will break ground next month on a five-story Marriott SpringHill Suites hotel on Ogletown Road, officials announced Tuesday.

Read MoreNews | February 8, 2017

Dallas developer Craig Hall's lending arm extends $37M to luxury project in Florida

Dallas developer Craig Hall's structured finance division — Hall Structured Finance — has made a $37.7 million loan to finance the construction of a luxury apartment community near Orlando in Florida.

Read MoreNews | September 30, 2016

How One Company is Pulling Hospitality CRE Back on it's Feet

For every commercial real estate venture that receives easy funding, there are dozens that struggle to hunt down the capital they need.

Read MoreNews | September 26, 2016

5 things borrowers should know, featuring Matt Mitchell, VP of HSF

The hotel industry, and the lending environment in particular, is in a state of transition as many wonder when the cycle will end. But lenders speaking at the recent Hotel News Now Lender Roundtable said that doesn’t have to be a bad thing. Here are some of their takeaways on the state of the industry.

Read MoreNews | September 21, 2016

Lender Insights: Roundtable edition

Hotel News Now recently gathered a roundtable of hotel industry lenders, including HSF's Matt Mitchell, to share their opinions on the state of hotel financing and the industry in general.

Read MoreNews | August 22, 2016

Three Questions With Mike Jaynes, president of HALL Structured Finance

Dallas developer Craig Hall knows a thing or two about financing developments and construction projects. And, with that experience, Hall formed a lending division of Hall Group about two decades ago that has been putting equity into developers’ hands.

Read MoreNews | August 3, 2016

Condo project near beach secures $36M construction loan

The developer of the Gale Residences Fort Lauderdale Beach obtained a $35.6 million construction loan four months after starting work on the site.

Read MoreNews | August 2, 2016

Contrarian Investor HALL Structured Finance Sets Sights on Houston

The Houston market is incredibly diverse and resilient, characterized by a robust local economy, aspects of which are immune to energy shocks. The team at HALL Structured Finance (HSF) is bullish on Houston’s long-term prospects, confident the city will continue to expand its role as one of the preeminent centers of global commerce.

Read MoreNews | July 22, 2016

HALL Structured Finance Provides $10.9M Construction Loan for Milwaukee Hotel

TownePlace Suites by Marriott will be a four-story, 112-room hotel in Oak Creek, 13 miles south of Milwaukee.

Read MoreNews | November 6, 2015

HALL Structured Finance’s $100M Quarter

Hall Structured Finance has closed on more than $100M in loans in the past quarter and expects to end the year with almost $200M in loans.

Read MoreNews | July 28, 2015

I-Drive hotel secures $18M in construction financing

The planned eight-story, 175-room Hyatt House Hotel on International Drive has the financing needed to begin construction.

Read MoreAll Articles Loaded